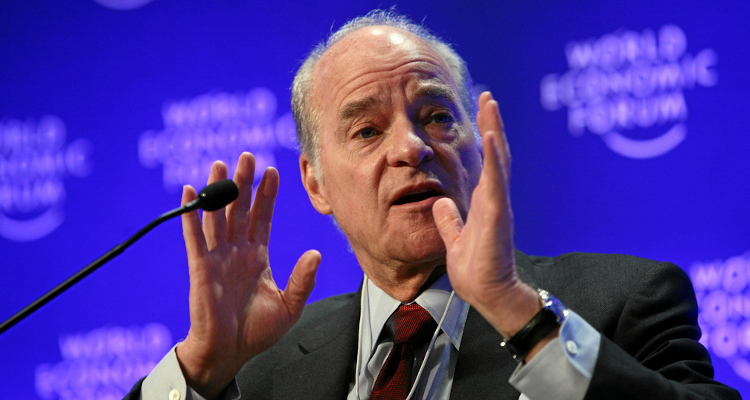

KKR co-founder Henry Kravis. Photo Credit: World Economic Forum

Kohlberg Kravis Roberts (NYSE: KKR) has officially purchased Kobalt Capital’s over 62,000-track KMR Music Royalties II portfolio for about $1.1 billion.

New York City-headquartered KKR and 11-year-old Kobalt Capital unveiled their more than billion-dollar agreement via a formal release that was emailed to DMN. Per this concise announcement message, KKR – which in March partnered with BMG to acquire music IP – joined “co-invest partner” Dundee Partners in fronting the capital for today’s deal.

Dundee Partners is “the investment office of the Hendel family,” but the involved parties don’t appear to have publicly revealed their respective stakes in the portfolio, which “is comprised primarily of music publishing copyrights for established works.”

In any event, Kobalt Music Publishing “will continue to administer and service” the works “under a multi-year agreement,” and KKR and Dundee Partners established an investment platform called Chord Music Partners to complete the transaction. KKR is set to “contribute other music assets purchased over the past year to Chord,” with an overarching goal of “positioning the platform as owner of a diversified portfolio of music rights representing some of the most iconic musical works from the last five decades.”

Notwithstanding this roughly $1.1 billion investment and the multitude of other deals that have arrived in the catalog space since 2020’s start, KKR partner Jenny Box in a statement appeared to indicate that her company intends to make different music-IP purchases yet moving forward.

“We are thrilled to purchase this diverse collection of iconic songs. We look forward to investing in the success of this music and working collaboratively with Kobalt and the artists and songwriters who created it,” said the former Oaktree Capital Management managing director and Blackstone Group associate Box.

“This transaction positions us with significant scale, which we will continue to grow by providing flexible, creative capital to music rights owners. Across KKR, we are investing in innovative technology, media and entertainment businesses that are connecting fans to music in new ways and we are excited about how this can enhance the value and reach of these songs,” finished Box.

KKR kicked off 2021 by acquiring the music copyrights of OneRepublic’s Ryan Tedder, and the aforementioned Blackstone one week back made a $1 billion investment of its own in music rights – besides securing an ownership stake in Hipgnosis Song Management.

Additionally, Spirit Music Group owner Lyric Capital launched a $500 million catalog fund last Thursday, while Primary Wave, having dropped a reported $50 million on Bing Crosby’s IP on Monday, closed out the week by obtaining a stake in the catalog of “Will You Love Me Tomorrow” songwriter Gerry Goffin.