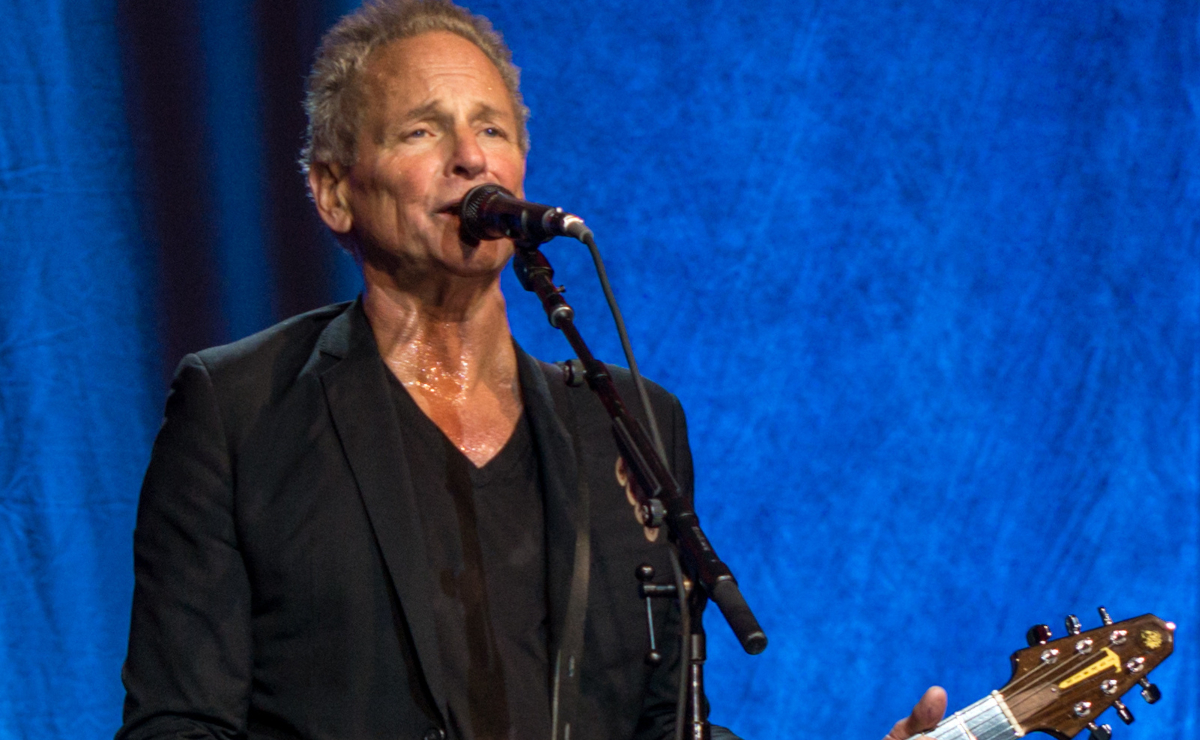

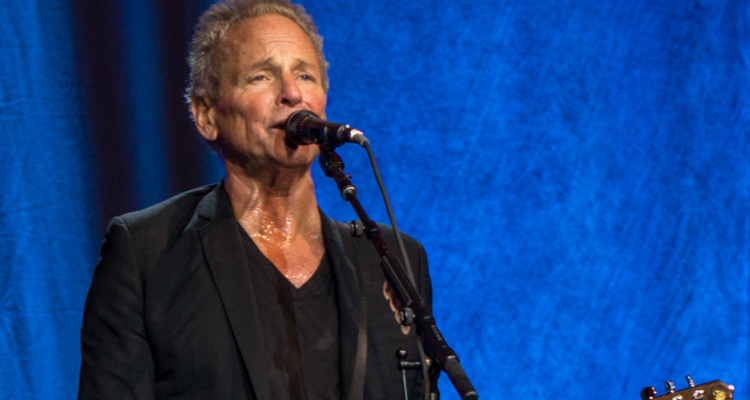

Lindsey Buckingham. Photo Credit: Raph_PH

One day after announcing that it had acquired the 259-song catalog of veteran producer Jimmy Iovine, Hipgnosis has purchased the publishing catalog of longtime Fleetwood Mac lead guitarist Lindsey Buckingham.

Hipgnosis execs unveiled their fund’s latest high-profile acquisition – encompassing the entire 161-song catalog of Lindsey Buckingham as well as a 50 percent publishing interest in his future works – today. The 71-year-old Buckingham penned a number of Fleetwood Mac tracks across his 33 total years with the band, including “Monday Morning,” “Second Hand News” (the opening song on the group’s ultra-successful 1977 album Rumors), and “Go Your Own Way,” to name just some.

Additionally, the Palo Alto native has released six solo albums to date, and wrote all but two of the works on 2017’s Lindsey Buckingham Christine McVie, which featured four Fleetwood Mac members (including Buckingham and McVie). The financial terms of the Hipgnosis-Buckingham deal haven’t been publicly released, but the UK-based song investment company evidently outbids competing buyers in many instances.

As an interesting aside, however, Stevie Nicks – who joined Fleetwood Mac with Buckingham in 1975 but clashed with the guitarist ahead of his 2018 departure from the band – closed a reported $100 million publishing deal with Primary Wave about one month ago. Separately, despite exiting the group following a contentious lawsuit, Lindsey Buckingham has also embraced the TikTok trend that saw many younger fans create videos featuring “Dreams.”

Time will tell whether the three-year-old Hipgnosis’s risky – and, in turn, potentially lucrative – bet on the long-term earning potential of music IP pays off. But by announcing two major catalog acquisitions this early in 2021, following an extremely active 2020, the Merck Mercuriadis-founded entity looks to have signaled that further purchases (and heightened leverage) are forthcoming.

According to Hipgnosis’s newest half-year report, which released in December, the London-headquartered entity had invested north of $1.6 billion (£1.18 billion) as of September 30th. 63 catalogs were added to the company’s roster during the six-month period, bringing the grand total of purchased assets to 117 catalogs and 57,836 tracks.

Net revenue touched $61 million during the stretch (£44.8 million), while an “independent valuer” determined that the “fair value” of Hipgnosis catalogs hiked by $155.6 million (£114.2 million). Notably, the text also specified that Hipgnosis’s investment adviser, The Family (Music) Limited, is presently “in advanced stage discussions on an investment pipeline of over £1 billion [$1.36 billion].”

At the time of this piece’s publishing, Hipgnosis stock, traded as SONG on the London Exchange, was down about four percent from yesterday’s close, with shares trading for $1.68 apiece.