The past ten years have witnessed an explosion in ‘marketing tech’—digitizing labor-intensive processes and liberating time for value-adding employees. Now, we’re seeing a similar evolution in financial tech.

Music companies are straying from the established norm—full-scale ERP systems with an excess of functionality—towards new tools that are democratizing the individual components of the finance function. The ability to automate manual functions, deliver better real-time data to decision makers and elevate finance workers to more strategic partners are all critical for tomorrow’s organizations.

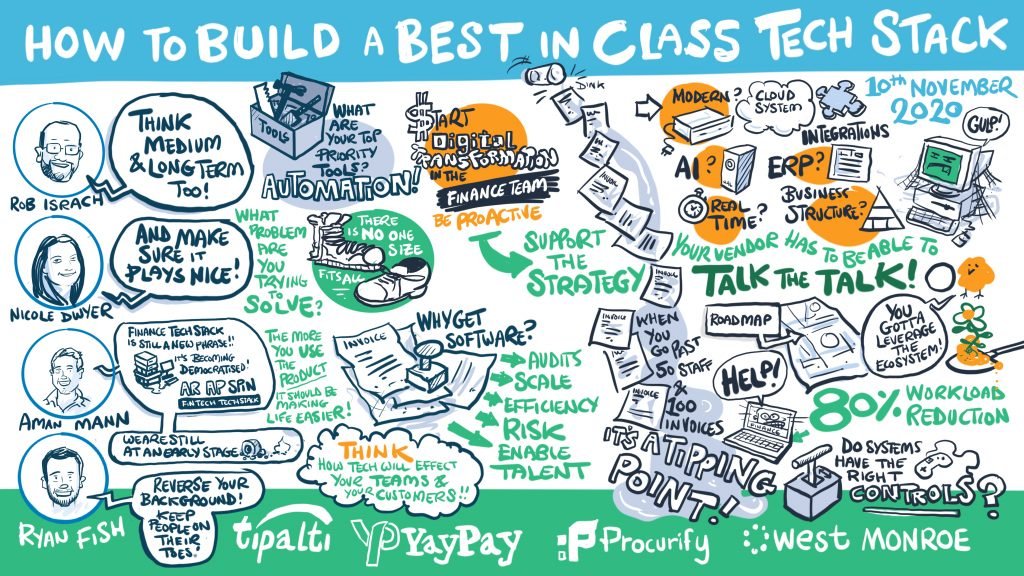

While it’s easy to start by chasing impressive features (more automation, smarter integration, simpler compliance), companies should start by looking inwards: what are the most pressing needs of your finance team? Where can manual labor, inefficiencies, bottlenecks and opaque processes be improved for maximum benefit? As your organization scales, what new problems are likely to arise?

With the pressing demands of modern-day music finances in mind, Digital Music News recently joined forces with fintech powerhouse Tipalti to break down the 11 critical pillars of a successful music financial stack. Today, Tipalti supports some of today’s fastest growing music companies like DistroKid, Splice, TuneIn, Audiomack, Spare Music, and more.

Auditability

Successfully getting acquired or going public are among the foremost ambitions of all high-growth music companies. However, achieving the necessary financial transparency is a massive challenge—one that is often overlooked.

The sheer quantity of complex financial preparations will overwhelm most finance teams, particularly those whose internal systems are too small or too outdated.

And the faster you’re growing, the further you need to look ahead: appropriate financial management software should be adopted at least 1-2 years before going public. This means trading in your basic accounting software and implementing dynamic, cloud-based financial management tools that can provide:

- Clear views of all financial operations

- Audit trail logs capturing all user activity in the system

- Full and fast reporting capability (with minimal manual input)

- Automatic checks against fraudulent vendors or payees (e.g. screening with OFAC)

- Automatic flagging of payment errors

- Powerful analytics that provide deep insights into what is (and isn’t) working from a business and finance perspective

As well as improving auditability, investment in new financial software also frees up your finance employees for more strategic and value-adding work. At the same time, persisting with legacy systems adds significant risk and control issues for any company approaching an IPO or acquisition.

“Evaluating the needs of your tech stack can be really tricky, but it’s critical to not only think about your short term goals, but also, about your medium and long term goals,” explained Tipalti’s Senior Managing Partner Evan Heby. “Do you have the infrastructure to support where you want to be in the next fiscal year? What about in five years? Without systems that can help with auditability, your business’s goals could be at risk.”

Long-Term Scale

Digital transformation within the finance function is crucial for long-term scalability. Research from McKinsey concluded that 57% of finance activities can be fully or mostly automated; for general accounting operations it’s 80%.

The CFO and finance team must proactively and systematically identify tasks and processes within the finance function that would most benefit from digitization—and only then look at solutions.

Take Splice, the industry-leading audio sample library. Processing their quarterly royalty payments used to take up eight full weeks of labor a year. Now partnered with Tipalti, royalty payments take one hour per quarter. AP invoice processing that used to take 36 days a year is now fully automated.

As noted by Splice accountant Nas Yaqoobi: “I literally just upload the payments into Tipalti, and it just pays it from there. I don’t have to do any manual work. In terms of scaling, we’re definitely set up for success. Our payments process is no longer a huge burden for finance.”

With the right systems in place, Splice can manage thousands of different artists and labels with ease—and start expanding internationally with confidence.

Efficiency

Building an effective financial stack means maximizing efficiency, and there are many ways to do this. The most powerful example is the reduction of manual effort (e.g. faster collection of data from artists or simplifying onboarding) through automation. What’s pivotal is to identify the most pressing problems first, then implement change in order of priority.

For most finance teams, this means tackling AP, AR and spend. These are heavily time-consuming manual operations that can be made significantly more efficient through automation.

For example, automating AP not only accelerates your monthly close (from weeks to one hour, in the case of Splice), it also frees up the finance function to add more strategic value across the company.

In the case of TuneIn—another established Tipalti partner in the music industry—the ability to proactively eliminate payment errors (as well as informing suppliers when and why payments have failed) was a massive win. According to Senior Accounting Manager Fred Mooney: “Tipalti has literally cut out hours and hours of time for our controller, let alone our accounts payable people. Controller level time is worth a lot of money and if you can cut out a couple of hours a month of them having to deal with wire payments and stuff, that’s invaluable.”

This is just one of the many automated services Tipalti offers for managing both domestic and international payments.

Risk Management

With increasing influence over strategic decision making across the organization, your finance function will bear more responsibility (and greater scrutiny) than ever. It’s essential to future-proof your organization for success.

Automation, deployment of new tools and training of employees can be transformational in reducing manual effort (and therefore the risk of fraud or human error) and facilitating scaling without additional headcount.

AP is one area where you can leverage your finance stack to make massive gains for the broader finance function.

Improvements to your monthly close will enhance performance visibility, allowing leadership to make faster, better decisions. Maverick spending can be reined in entirely, with powerful procurement and payables solutions like Tipalti’s prepaid debit cards: companies load these cards to cover very specific, recurring expenses such as technology subscriptions.

“Tipalti’s prepaid card functionality helps us manage subscription spend because you can see it all in one place,” Mooney relayed. “Subscription spend for any technology company is like a beast. So anything you can use to manage that in a technology company is useful.”

Overspending and double-payments are also eliminated while the real-time view of finances is more reliable.

Enabling Talent

The finance function is changing. New generations of workers want to help grow and steer the business; they’re looking to become strategic advisors and partners, and expect the manual parts of their job to be automated.

The backbone of any high-growth business is the numbers, and your finance team represents those numbers.

Embracing tools which allow your finance team to become a more strategic entity is a crucial element of the ultimate fintech stack. You need sophisticated systems which enable employees to spend less time on manual transactional work and more time using the data generated to make an impact.

Investment in your employees (both the hottest new talent and your veteran professionals) is essential for creating the highest-impact finance function—both tomorrow and over the long-term.

Crisis Management

Your organization runs on its financial data. It is your responsibility when building a financial stack to ensure the finance function is bulletproof in the face of all crises.

From this perspective, the most crucial aspect of any new system is accessibility: cloud-based systems which can be managed and accessed from any location or device; data that is securely and regularly backed up; remote-capable processes and systems that allow your teams to be productive from any location.

It’s also important to provide real-time visibility of the company’s complete financial position, and to perform ongoing reforecasting for 20%, 50% or higher drops in revenue. For global companies, your systems must have robust, global capabilities built-in.

In light of Covid-19 and the multiple recessions of the 21st century, there is no excuse for a lack of preparedness within your finance team.

Interoperability with Other Systems

Systems within finance teams have a history of not playing well with others. When building your financial stack, collaboration and integration of core systems—both within finance and with other operational systems like HR, sales, and marketing—is paramount.

For example, your modern ERP system should be cloud-based and modular, with users able to add functionality like CRM or AP automation with established integrations to that ERP. This will massively reduce manual effort within the finance function, but also produce downstream benefits such as better-informed decision making for senior leaders.

Try to leverage existing partnerships: if one of your systems is missing a useful integration, ask if your partner can build it. If your organization is growing and ambitious, you can’t allow isolated backbone systems (such as a legacy ERP) to hamper your growth: search for an ERP that does integrate with other essential tools and systems and move forward.

Multi-Territorial AP Capability

For companies expanding internationally, it’s essential that your AP capability expands with it. The use of automation, machine learning and other powerful technologies will be instrumental in scaling more effectively and with less effort and cost.

Your financial stack should be capable of scheduling and securely sending thousands of simultaneous payments at scale, using multiple methods and currencies, all within a single application. Access to a variety of payment methods and currencies is essential.

This is particularly vital for the music industry, where there is a huge variety of complex payments to be made to partners across the world.

Visibility for partners—artists, creators, producers—is also paramount. Modern AP systems should allow partners to view all pending payments, control how they’re paid, and be alerted to any failed payments.

Global Tax Compliance

When scaling a business internationally, it’s crucial to have a system that can easily manage the varying tax requirements for every country in which you operate.

Remote working has completely changed the game, since companies can now grow in any direction at any scale. Global expansion can now mean hiring a few employees in one other country or building full-scale teams or subsidiaries across the world. In both cases, the international tax regulations can be surprisingly daunting.

Your software tools should be able to handle all areas of tax compliance, from pay-related taxes (pay deductions, pension contributions, insurance deductions, tax calculations etc) to VAT compliance for AP, dividends, corporation tax, tax relief and more for every country. Crucially, they should do this by automating where possible, minimizing both manual labor and risk.

Combining your internal tools with tax filing solutions like Zenwork’s Tax 1099 can have a huge impact on your ability to file quickly and accurately at year end.

User Friendliness

Your creative partners deserve prompt and stress-free payments—enabling this is a crucial element of the financial stack.

At TuneIn, the finance team calculates the payments for every artist and PRO on a quarterly basis, storing the data in a CSV file. This is uploaded to Tipalti which automatically generates all the invoices and initiates the approval flow—instantly. “It’s instant, literally instant. It takes one day to get every invoice uploaded and approved and paid. It saves countless hours every quarter working this way,” Mooney said.

Machine learning algorithms even approve recurring payments automatically, within predefined thresholds. While speed and ease are important, it’s also crucial that your artists, creators and PROs are in full control of their own payments.

TuneIn’s partners choose their own payment methods. They can see the status of their payments at any time (e.g. expected payment date), view historical data and receive notifications of delays, failed payments or other activity.

This visibility massively improves the user experience for artists, but also liberates time for finance workers by eliminating laborious manual work.

Specific License Type Itemizations

The music industry is notorious for its complex licensing landscape. As companies span an ever broader range of music IP, the challenges multiply. For example, few artists and stakeholders exist in a single country. This means royalty accounting and payouts are often reconfigured for dozens of territories across multiple license types.

In most cases, songs have multiple owners, each claiming a specific ownership percentage. The resulting AP and AR puzzles place heavy and unique demands on music fintech stacks. At the bare minimum, fintech solutions must have the capability to itemize licenses across publishing and recordings, with areas like performance rights, mechanical licenses, and streaming platform payouts cleanly managed and individual rights owners compensated properly.

A robust music fintech stack should also interface with the dozens of organizations that manage specific licenses within various countries. This includes everything from SoundExchange and the Mechanical Licensing Collective (MLC) in the US, to Stim in Sweden and PRS for Music in the UK. But those are just a few examples, with each territory typically containing numerous licensing orgs.

So, What’s the Next Step?

Building a game-changing financial tech stack requires your organization to set itself up for success—that means starting with the problems first, and solutions second. Understanding your company’s highest-priority needs and then looking for the best way to solve them for the long-term.

Remember you’re not expected to achieve total digital transformation overnight. Start by digitizing the most crucial tasks with the most validated solutions, then build from there. Creating an effective financial stack is about incremental, prioritized change. You need to prove your solutions work for the most pressing issues before looking to scale across the organization or solving other issues.

The accumulated returns of a finely-honed financial stack will be staggering in the long-term. A great way to get started would be learning more about how automating payments to your artists can improve your business’s operations – learn more today.